[ad_1]

Axis Financial institution has lately added the flexibility to switch Edge Reward factors to Associate factors and miles which is among the main transfer taken by Axis Financial institution to serve the prosperous clients of the financial institution.

Under switch fee from Edge Rewards to Associate factors & miles are relevant for Prosperous / HNI playing cards solely: Magnus, Reserve & Burgundy Private. Axis Atlas is dealt individually.

Different playing cards switch at 10:1, which is poor and never price transferring, therefore not masking them on this article.

Airline Companions

| Airline | Loyalty Program | Switch Ratio (Atlas Miles:Associate Miles) |

Switch Ratio (Edge Rewards: Associate Miles) |

|---|---|---|---|

| Singapore Airways | Krisflyer | 1:2 | 5:4 |

| Qatar | Privilege Membership | 1:2 | 5:4 |

| Etihad | Etihad Visitor | 1:2 | 5:4 |

| United | Mileage Plus | 1:2 | 5:4 |

| Ethiopian Airways | Sheba Miles | 1:2 | 5:4 |

| Turkish Airways | Miles & Smiles | 1:2 | 5:4 |

| Air France KLM | Flying Blue | 1:2 | 5:4 |

| Spice Jet | Spice Membership | 1:2 | 5:4 |

| Air Asia | Air Asia Rewards | 1:2 | 5:4 |

| Air Canada (New) | Aeroplan | 1:2 | 5:4 |

| Japan Airways (New) | JAL Mileage Financial institution | 1:2 | 5:4 |

| Qantas (New) | Frequent Flyer | 1:2 | 5:4 |

- Anticipated turnaround time to switch: 1 Day for Etihad, Air France, united (on the spot) & Spice Jet (others: 10 Days)

Lodge Companions

| Lodge | Loyalty Program | Switch Ratio (Atlas Miles:Associate Miles) |

Switch Ratio (Edge Rewards Miles:Associate Miles) |

|---|---|---|---|

| Marriott | Marriott Bonvoy | 2:1 | 5:4 |

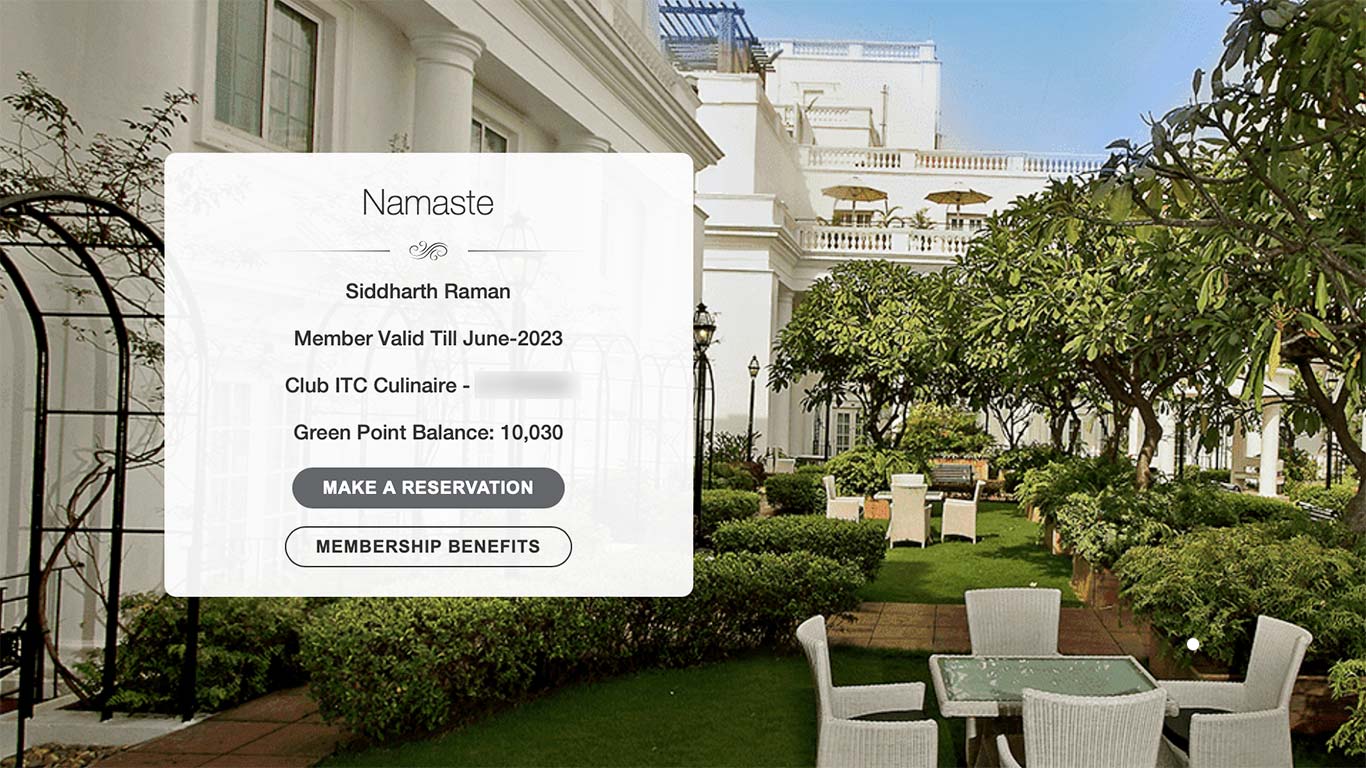

| ITC | Membership ITC | 1:2 | 5:4 |

| IHG | IHG Rewards | 1:2 | 5:4 |

- Anticipated turnaround time to switch: 1 Day for Marriott & IHG / 10 Days for ITC

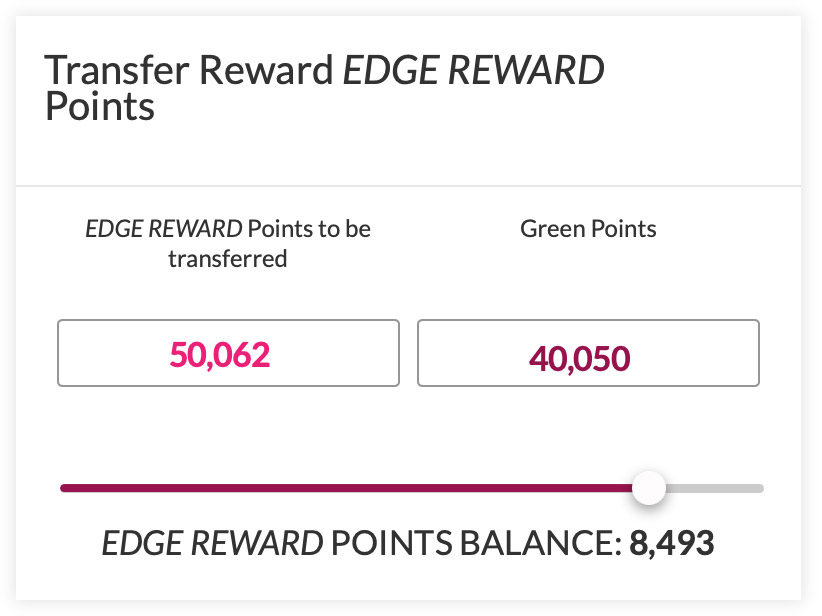

Be aware: Axis techniques have been having a difficulty initially when it went reside a day again. So whereas transferring be sure you’re seeing the correct “switch ratio” within the slider.

What’s the reward fee?

Should you spend 1 Lakh on Axis Magnus and Reserve, that is what you get:

- Magnus: 4800 +20,000 (milestone profit) = 24,800 accomplice Miles

- Reserve: 6000 Associate Miles

Magnus is certainly a MIND BLOWING card for spends upto 1L, for spends greater than a lakh, Reserve is best. For worldwide spends, reserve is the one card you ever want going ahead, because it provides 2X rewards.

So if you happen to have a look at the reward fee angle on common home spends, it seems to 2.4% – 4.8% on Magnus (~24% on 1L spend) and three% to six% on Reserve assuming a conservative worth of 0.50 INR to 1 INR on choose accomplice factors and miles.

However it’s certainly not a simple sport if you happen to do-not know what you’re doing. For many cardholders, Marriott & ITC factors transfers are easy to start with. And for the specialists the airline switch might come useful.

With this addition American Specific Credit score Playing cards looses its main USP (Marriott switch) and so spends will transfer to Axis Premium Playing cards, as reward fee is lot higher with Axis.

I imply why would anybody use Amex Platinum charge to earn 2.5K Marriott Bonvoy factors (1L spend) whilst you can earn 4.8K(Axis magnus) or 6K(Axis reserve) as an alternative?!

Tips on how to Switch?

It’s tremendous easy and you are able to do it in matter of few clicks.

- Login to Journey Edge portal (use the identical login credentials you employ for Axis a/c login)

- Select “Hyperlink Member” on the highest proper. Fill the main points of the switch accomplice.

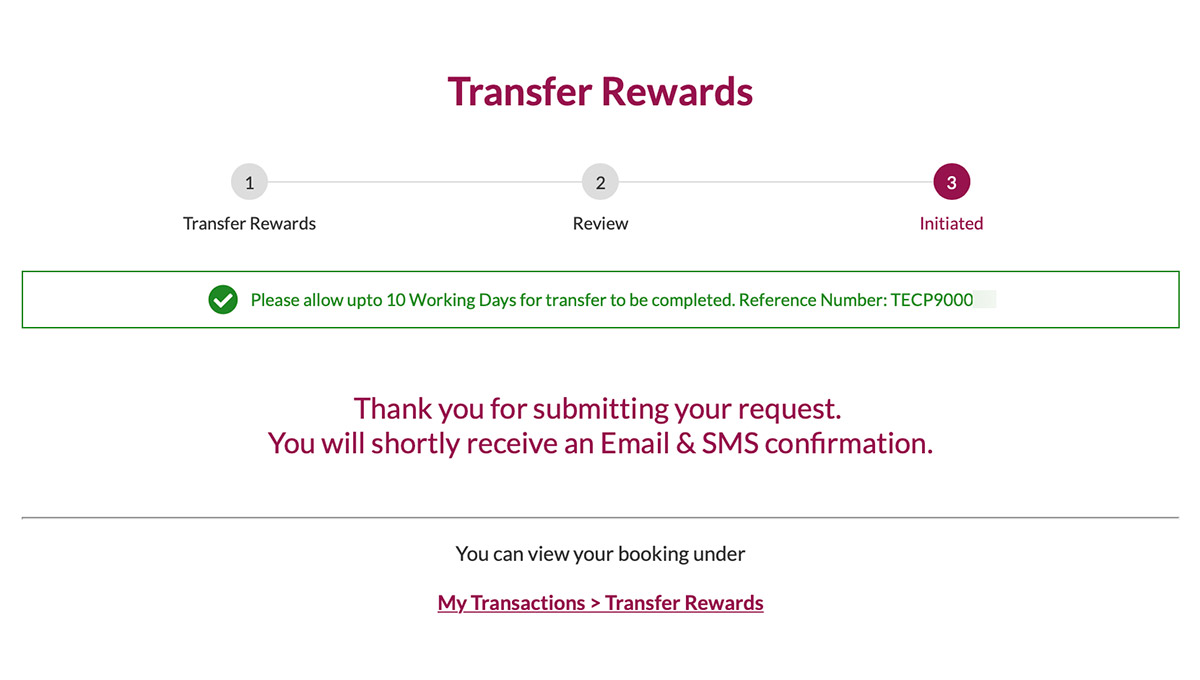

- As soon as completed, select “Switch Rewards” on high proper, select this system and factors required to switch utilizing the slider and submit.

- It takes wherever between 1-10 days for the switch to occur.

Newest Updates

Listed here are the common time taken to switch your Axis factors to respective loyalty packages in actual life:

- Marriott Bonvoy – Immediate

- United: Immediate

- Krisflyer – Upto 3 days

- Membership ITC – Upto 10 days

- IHG – 1 day

- Turkish – 2 days

- Etihad – 1 day

Be happy to report the time taken to switch to different companions, simply incase if you happen to’ve tried these transfers.

Ultimate Ideas

What can I say! The golden age of Indian bank cards has simply begun. Benefit from the complimentary flight ticket redemptions and lodge stays so long as you want.

Make hay whereas the solar shines!

To not neglect that the solar is shining for the second time in latest instances and you understand how lengthy it lasts.

So we would see some adjustments on conversion ratio in future as increasingly more cardholders discover the factors switch choice, simply as all the time which occurs with any profitable program.

However I hope we could have adequate time to take pleasure in the advantages and maybe that helps us to ultimately discover the Life beyond Credit Card Rewards.

*** Blissful days forward ***

[ad_2]