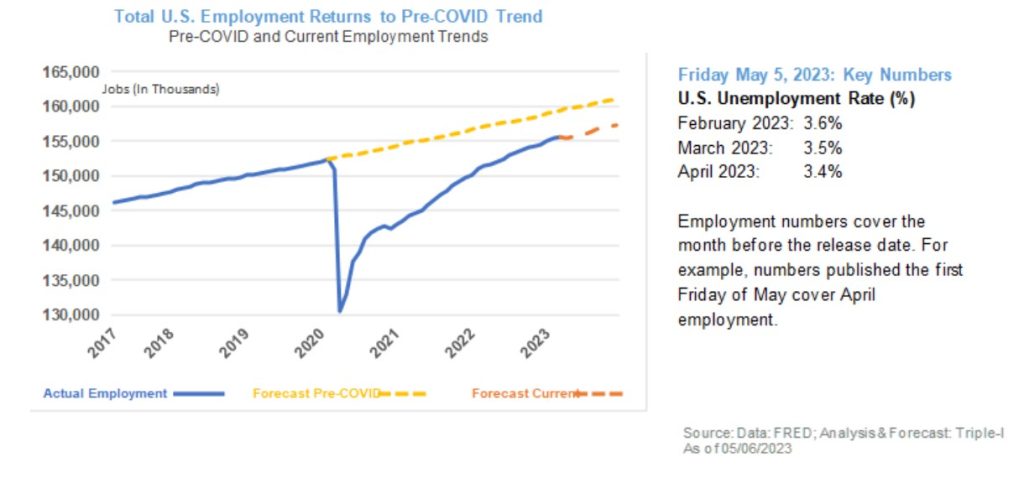

How the 2023 Banking Crash Reminds Us Why Insurance coverage Solvency Issues

This put up is a part of a sequence sponsored by AgentSync. With a slew of latest monetary establishment failures, it’s an vital time for insurers to place solvency entrance of thoughts. All through March of 2023, the world anxiously watched as a series of bank failures created extra volatility than we’ve seen for the ... Read more