[ad_1]

A number of of us have contemplated the purchase now or purchase later query in terms of a house buy.

The waiters are ready for dwelling costs to fall, figuring out affordability is traditionally low.

The non-waiters both can’t wait or don’t wish to wait as a result of they anticipate competitors to warmth up as soon as issues flip round. Or they merely purchased not figuring out costs had peaked.

However is it doable to get the perfect of each worlds? Can you purchase a house for much less and refinance to a decrease fee later?

Let’s take a look at the mathematics to see how this is able to pan out.

These Who Didn’t Wait to Purchase a House

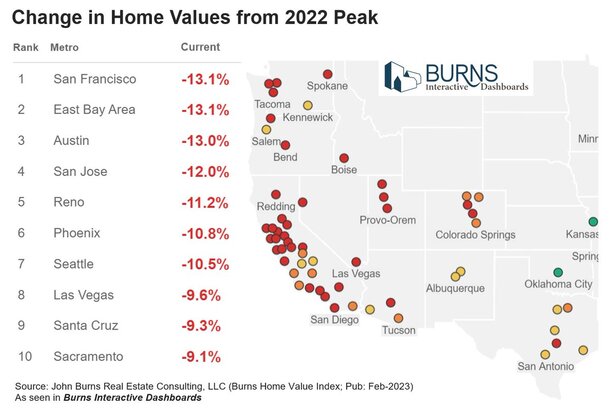

I’m going to make use of the Austin, Texas metro for this train. Costs there are apparently down about 13% from their 2022 peak.

Let’s assume somebody purchased a house there through the “peak” for $600,000 and put down 20%.

That’s a down fee of $120,000 and a mortgage quantity of $480,000. We’ll assume they received a 30-year fastened set at 3.75%.

The month-to-month principal and curiosity fee is $2,222.95. Fairly low fee, however they go to Redfin/Zillow and discover that their property is now valued at round $525,000. Ouch.

Due to their 20% down fee they aren’t in a detrimental fairness place. However their LTV is now over 90%, at the very least on paper.

They’re principally not going anyplace, however they’ve received that superior 3.75% fixed-rate mortgage for the following three a long time.

These Who Waited to Purchase however Missed the Mortgage Charge Backside

Now let’s think about a purchaser coming into the market in February 2023 with dwelling costs down about 13%.

That $600,000 house is now priced to promote for round $525,000. This implies a 20% down fee units them again $105,000. And the mortgage quantity at 80% LTV is $420,000.

Excellent news on the decrease down fee and the smaller mortgage quantity. Nevertheless, the 30-year fastened climbed to a a lot greater 6.5%.

That leads to a P&I fee of $2,654.69 per 30 days, a full $431 greater than the person who paid $75,000 extra for a similar fundamental dwelling.

If the mortgage is held to maturity, we’re speaking about $536,000 in complete curiosity paid.

The three.75% mortgage would lead to complete curiosity of simply $320,000.

This doesn’t look good for the house purchaser who waited for costs to come back down, given the huge enhance in mortgage rates.

However what if charges calm down once more by the tip of 2023?

The Latest House Purchaser Who Refinances Their Mortgage

| $600,000 Buy | $525,000 Buy | $525,000 Refinance | |

| Down fee (20%) | $120,000 | $105,000 | n/a |

| Mortgage quantity | $480,000 | $420,000 | $420,000 |

| Mortgage fee | 3.75% | 6.5% | 4.5% |

| Month-to-month P&I | $2,222.95 | $2,654.69 | $2,128.08 |

| Curiosity paid | $320,262.00 | $535,688.40 | $346,108.80 |

| Whole paid | $800,262.00 | $955,688.40 | $766,108.80 |

Let’s think about a state of affairs the place inflation will get beneath management, the Fed stops elevating charges, and long-term mortgage charges ease.

No, not again to three%, however name it 4.5%. The client takes benefit of this and will get their fee right down to 4.5% through a rate and term refinance.

The month-to-month fee drops to $2,128.08, about $100 lower than the one who purchased on the “peak.”

And the entire quantity paid over the lifetime of the mortgage is about $766,000 versus roughly $800,000 on the mortgage taken out on the peak.

The latest purchaser stills pay a bit extra curiosity, however much less general on account of a smaller quantity borrowed.

After all, this solely works if mortgage charges fall moderately considerably, from the 6% vary to the 4% vary. It’s definitely doable, however not a assure.

And within the meantime the month-to-month fee is $400+ further. Tick tock.

Nonetheless, the customer with the upper mortgage fee has choices, whereas the customer with the below-market fee can’t actually enhance upon their state of affairs.

One other perk to the decrease gross sales value is a greater tax foundation, and probably much less competitors from different consumers if greater charges dampen demand.

The draw back is you’d need to undergo the stress and aggravation of the house mortgage course of twice.

And as famous, there’s no assure mortgage charges truly come down.

However that is the essential premise of the marry the house, date the rate line you will have come throughout.

The caveat is that if dwelling costs proceed to slip, it could possibly be troublesome to refinance on account of LTV constraints.

[ad_2]