[ad_1]

RBI allowed use of Credit score Playing cards by way of UPI platform on 09th June 2022 beginning with Rupay Credit score Playing cards. Razorpay turned the primary fee gateway to assist Credit score Playing cards on UPI.

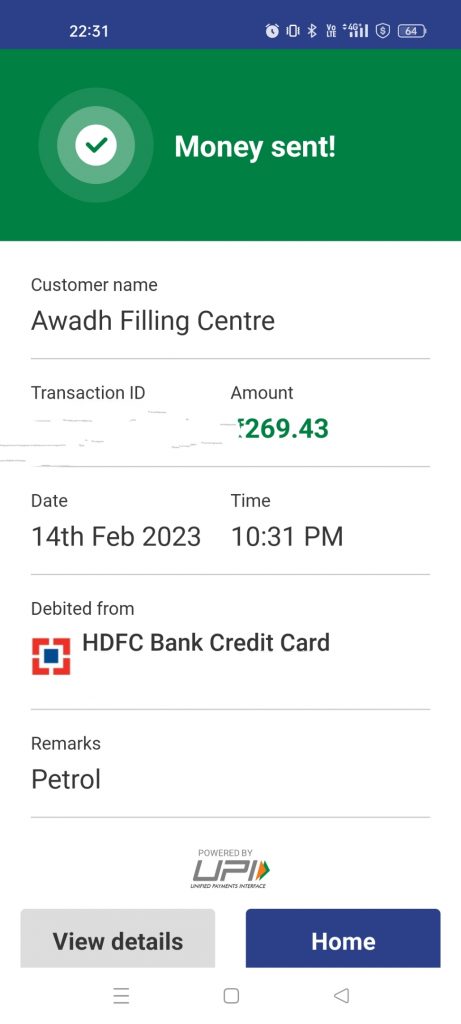

Till 14th February 2023 afternoon, solely 3 banks formally allowed this by way of UPI viz. Punjab Nationwide Financial institution, Indian Financial institution & Union Financial institution of India. From 14th February TATA Neu vary of Rupay Credit score Playing cards from HDFC Financial institution additionally went LIVE on BHIM UPI.

In a while it went LIVE on TATA Neu, Freecharge & Payzapp as effectively inside few hours. With this HDFC Financial institution turned the primary personal sector financial institution to take action.

Listed below are my ideas & expertise with UPI on my HDFC TATA Neu Infinity Credit Card which I bought hands-on not too long ago.

PRO’S for Retailers

- Common order worth are usually larger when patrons use bank cards

- Value of sustaining a Card swipe machine could also be a factor of the previous quickly

- Simpler bank card funds & happier prospects

PRO’S for Prospects

- No further costs for utilizing Credit score Playing cards on UPI (as of now)

- Ease of UPI with flexibility of utilizing Credit score Playing cards

- Prospects gained’t have to make use of their Money or cash on A/c for each day UPI transactions

- No want to hold Credit score Playing cards in pockets for funds in future, for these class of distributors who don’t settle for Credit score Playing cards

- Earn RPs on UPI transactions as effectively. That too for distributors the place CC acceptance is NIL e.g. Veggies/ Fruits/ Small outlets and many others.

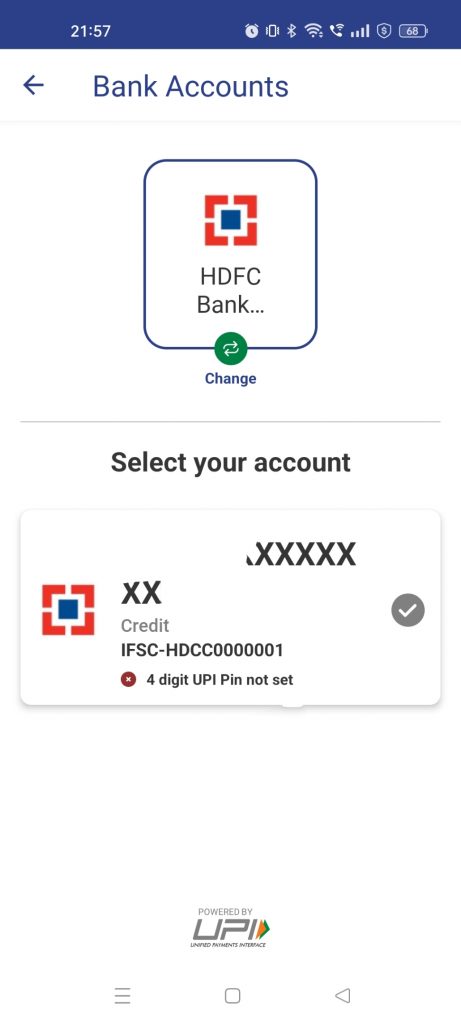

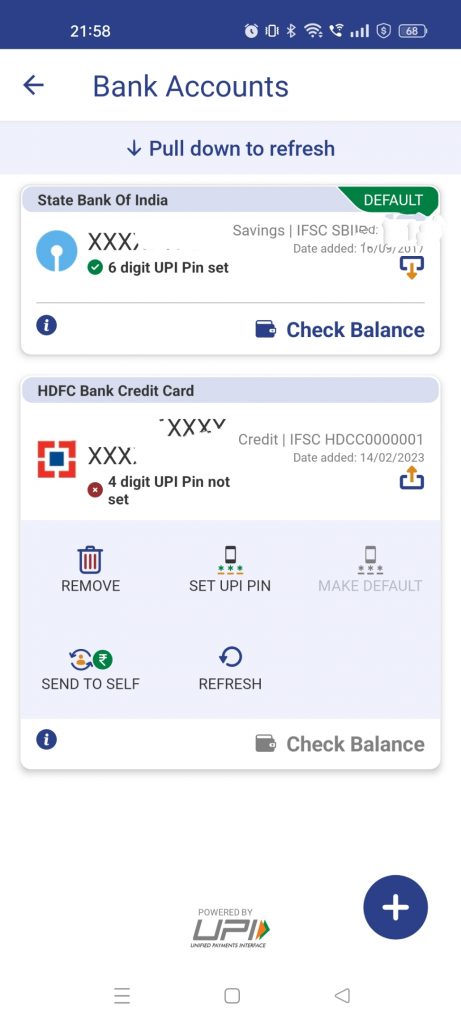

Including Credit score Playing cards on UPI apps

Now that you've a Rupay bank card LIVE on UPI (be it TATA Neu Infinity CC or another Rupay CC from PNB, Indian Financial institution, Union Financial institution of India & even HDFC Regalia/ TATA Neu Plus and many others), right here’s how one can add it to UPI apps, so you should use for UPI transactions.

- That is the easy course of on BHIM app–

- Login into BHIM app & register if not already achieved.

- Press the Retweet kind trying tab on apps high heart

- On subsequent web page backside proper nook use Plus image as proven beneath in 2nd picture.

- Add the Rupay bank card by finishing the verification & you might be good to go

Notes on Different UPI Apps:

- Paytm (whereas Android app v10.23.0 Beta model reveals an possibility so as to add Rupay CC on UPI, different variations not), Phonepe, Gpay needs to be Stay quickly.

- Mobikwik now permits so as to add Credit score Card on UPI with its newest replace dated 18th February (Beta model might need allowed this earlier too)

- As there is no such thing as a restriction to the variety of Rupay CCs that may be added, when you have a number of Rupay Credit score Playing cards from above Banks, all could be added to UPI

- Go to Rupay web site for the detailed tncs of the BHIM cashback supply seen above in picture (i.e. 10% upto 100 each month until 31.03.2023 on minimal transaction of fifty).

Notice that Rupay Credit score Card on UPI will work just for P2M transactions. P2P, P2PM gained’t work. Additionally funds can’t be obtained to linked bank card on UPI.

Rewards on UPI Spends

Tata Neu Infinity CC is presently crediting base RPs i.e. 1.5% Neucoins on fee by way of UPI fee mode, which is nice.

HDFC Financial institution days again got here out with a notification that it'll restrict RPs to 500 monthly on all HDFC Rupay CCs on UPI transactions. This implies max. spends could be ~ 33334/- monthly to be able to get 500 RPs.

As we get NeuCoins right here and never RPs, this appears little ambiguous. In follow although I've been getting 1.5% on all transactions thus far. Be mindful this may increasingly change in future as per above 500 monthly rule.

Make hay whereas the solar shines!

Transaction Limits on UPI

- 5000 INR for first 24 hrs

- 1L per day per card

- 2L per day per card (for some particular MCC codes)

Aside from that, there is no such thing as a restrict to the variety of transactions carried out by way of linked bank card on UPI.

My pretty massive transaction by way of Rupay CC on UPI went efficiently. 1 extra transaction which might have taken the cumulative spends to greater than 1L, bought failed vindicating the above transaction restrict rule.

QR Cost Expertise

Although I've been in a position so as to add Infinity CC to BHIM first on inaugural day itself i.e. 14th Feb 23 after which to TATA Neu, Freecharge, Payzapp as effectively inside 24 hours adopted by on Paytm (Beta model), transaction expertise on these have diversified fairly a bit. Listed below are my experiences–

- BHIM App- Flawless everytime on Paytm/Amazon QR largely & Gpay as soon as

- Payzapp- Tried twice on Paytm QR & profitable

- TATA Neu/ Freecharge- Tried on Paytm & Gpay QR, failed everytime

- Paytm- Profitable everytime

Bottomline

At the moment there is no such thing as a MDR charged to prospects utilizing their Rupay Credit score Card on UPI. NPCI is probably going working to make it win-win to banks, prospects & retailers.

Hope the Rupay/UPI expertise will get higher over time throughout all apps and fee gateways with out compromising on rewards.

[ad_2]