[ad_1]

Inflation has been extremely mentioned within the US all through 2022, with information articles and earnings calls highlighting its affect on client spending. As we entered 2023, we requested ourselves, how rather more did US shoppers spend because of elevated costs in 2022? Our evaluation exhibits that:

In 2022, US shoppers spent an additional $1 trillion because of elevated costs.

How do we all know this? We analyzed private consumption expenditures (PCE) information offered by the US Bureau of Financial Evaluation (BEA). The BEA offers the information for nominal PCE and actual PCE.

A rise in nominal PCE in comparison with earlier years is because of adjustments in each pricing and the quantity of products or companies. A rise in actual PCE in comparison with the earlier yr is because of adjustments in quantity solely. Within the graphic beneath, “The Affect of Inflation within the US,” we see that:

- In 2022, nominal PCE spending elevated to $17.4 trillion, up from $15.9 trillion in 2021. Actual PCE spending rose to $14.1 trillion, up from $13.7 trillion in 2021.

- As such, nominal PCE spending elevated by $1.5 trillion in 2022 (once more, reflecting each pricing and volumes) whereas actual PCE spending elevated by solely $0.4 trillion (reflecting quantity solely).

- The distinction between the 2 — $1.1 trillion — is what US shoppers paid further because of elevated costs alone. This determine is over 5 occasions the common quantity that buyers paid extra because of elevated costs in pre-COVID years.

What Did US Shoppers Spend That Cash On?

Trying on the BEA PCE spending information by class in 2022, US shoppers spent almost one-third of the complete PCE spend of $17.4 trillion on items and the remaining two-thirds on companies. Items spending elevated from $5.5 trillion in 2021 to $5.9 trillion in 2022, whereas companies spending elevated from $10.4 trillion in 2021 to $11.4 trillion in 2022.

The BEA breaks down items into sturdy versus nondurable items. Sturdy items have a shelf lifetime of three years or extra. In 2022, US shoppers spent almost one-third of the overall items spend on sturdy items and the remainder on nondurable items.

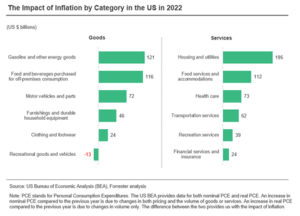

Right here’s the affect of inflation throughout totally different PCE classes:

- Items versus companies. Of the $1.1 trillion that US shoppers spent further because of elevated costs in 2022, US shoppers paid $468 billion further because of elevated costs of products and $636 billion further because of elevated costs of companies.

- Sturdy items versus nondurable items. In 2022, nondurable items total grew to become costlier than sturdy items. US shoppers spent $335 billion extra because of elevated costs of nondurable items and $133 billion extra on sturdy items.

- Nondurable items. The affect of inflation was very evident within the classes of gasoline, meals, and drinks. US shoppers paid $121 billion extra because of elevated costs of gasoline and different power items in 2022. Plus, US shoppers paid almost the identical quantity further because of elevated costs of meals and drinks (please see “The Affect of Inflation by Class within the US in 2022” chart beneath).

- Sturdy items. Motor automobiles and elements in addition to furnishings and sturdy family tools noticed the most important enhance in costs, with US shoppers paying $72 billion and $46 billion further, respectively, for these two classes alone. Leisure items and automobiles noticed deflation. The costs of televisions, different video tools, and data processing tools declined as an alternative of accelerating. Spending progress in these classes was volume-driven, not inflation-driven.

- Providers. Within the companies class, US shoppers spent $636 billion extra because of elevated costs, with housing and utilities, meals companies and lodging, well being care, transportation companies, and recreation companies seeing probably the most important affect.

Forrester can present additional insights on the expansion of US client spending in numerous classes throughout pre-COVID years and from 2020 to 2022, in addition to the greenback and proportion affect of inflation in numerous classes. When you’re a Forrester shopper, please schedule an inquiry or steering session with me to study extra.

[ad_2]