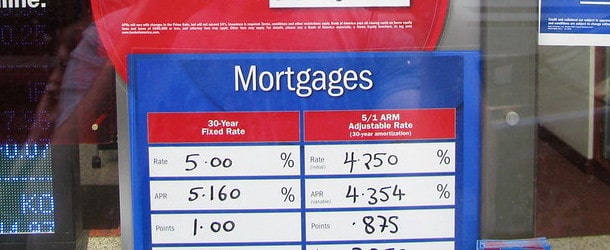

Practically 40% of Housing Markets Nationwide Have Returned to Their Peak Costs

[ad_1] For those who’ve heard that the housing market crashed, contemplate this. Practically 40% of markets nationwide have returned to peak dwelling costs on a seasonally adjusted foundation, per a brand new report from Black Knight. These markets are primarily situated within the Midwest and Northeast, together with Southern Florida. And one other six markets are ... Read more