[ad_1]

Welcome information for mortgage brokers, and considerably shocking

Whereas welcome information given her function as a mortgage broke,. Rebecca Richardson, of UMortgage, wasn’t utterly taken off guard by the event. Nonetheless, she added, the lowered charges solely added to the contradictory market stories amid as we speak’s unsure market.

“It was considerably anticipated after the decision of the debt ceiling standoff but additionally a bit shocking following optimistic job numbers,” she instructed Mortgage Skilled America. “Further ‘black swan’ margin was constructed into pricing in case it didn’t get resolved and I believe merchants are shedding a few of that and positioning for subsequent week’s Fed assembly.”

Republicans have been pitted in opposition to Democrats over elevating the debt ceiling on the nation’s $26 trillion financial system, with the previous threatening to vote in opposition to increasing the cap till concessions have been made. Each events got here to an settlement final weekend, stopping what would have been the nation’s first default on its money owed because it was shaped – a situation universally seen as catastrophic ought to it have occurred.

The jobs report to which Richardson referred got here from the US Bureau of Labor Statistics, displaying 339,000 jobs have been created in Could – far exceeding expectations by almost double the anticipated quantity.

Mortgage fee drop offers consumers hope

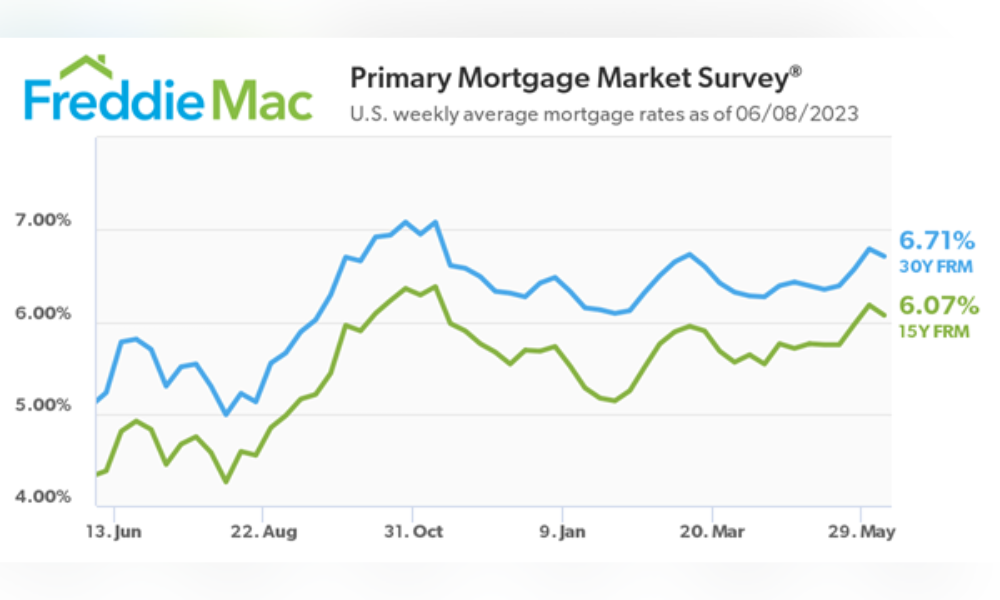

However the emergence of knowledge seemingly in contradiction with one another in opposition to a backdrop of uncertainty, the dip in mortgage charges does have a buoying impact, Richardson stated. “It places some wind within the sails of consumers and helps abate their fears,” she stated. “It additionally means it stokes demand in gentle of traditionally low stock. It means we've got a 2021 excessive demand market however with 2023 charges, which decrease affordability. It’s a troublesome dynamic for consumers, for positive.”

[ad_2]