[ad_1]

With fixed-rate mortgages not on sale, I believed it’d be helpful to try the highest adjustable-rate mortgage lenders nationwide.

These are the businesses that originated probably the most ARMs on a mortgage quantity foundation for the newest 12 months information is obtainable.

In 2021, some $611 billion in ARMs had been funded by over 3,000 mortgage corporations. So it clearly wasn’t a distinct segment product.

However 10 corporations stood above the remainder. And guess what? They’re all banks!

Learn on to see the highest 10 lists for extra particulars.

High Adjustable-Price Mortgage Lenders within the U.S.

| Rating | Firm Identify | 2021 Mortgage Quantity |

| 1. | Chase | $41.8 billion |

| 2. | Financial institution of America | $33.5 billion |

| 3. | First Republic Financial institution | $23.8 billion |

| 4. | Wells Fargo | $21.1 billion |

| 5. | U.S. Financial institution | $18.0 billion |

| 6. | PNC Financial institution | $11.7 billion |

| 7. | Charles Schwab Financial institution | $11.6 billion |

| 8. | Residents Financial institution | $11.0 billion |

| 9. | Union Financial institution | $10.1 billion |

| 10. | Citibank | $10.0 billion |

Coming in first place was JPMorgan Chase with practically $42 billion in adjustable-rate mortgages (ARMs) funded in 2021, per HMDA information from Richey May.

That was greater than sufficient to take the highest spot, with second place Financial institution of America mustering $33.5 billion in ARMs.

In third was First Republic Financial institution (sure that financial institution) with $23.8 billion funded, making them an enormous ARM mortgage participant as effectively.

And if the current fallout is everlasting, it's going to create a large hole within the residential ARM mortgage market.

Taking fourth was Wells Fargo with $21.1 billion in ARM origination quantity, adopted by U.S. Financial institution with $18 billion.

The remainder of the highest 10 included PNC Financial institution, Charles Schwab Financial institution, Citizens Bank, Union Financial institution, and Citibank.

For the report, Union Financial institution was acquired by U.S. Financial institution in late 2022. So there could be two vacancies within the high 10.

The highest nonbank ARM lender was Rocket Mortgage, which originated $6.2 billion in ARMs in 2021.

High 7/1 ARM Lenders within the U.S.

| Rating | Firm Identify | 2021 Mortgage Quantity |

| 1. | Chase | $13.2 billion |

| 2. | Financial institution of America | $11.7 billion |

| 3. | Wells Fargo | $11.1 billion |

| 4. | First Republic Financial institution | $8.9 billion |

| 5. | Charles Schwab Financial institution | $4.1 billion |

| 6. | Union Financial institution | $3.6 billion |

| 7. | U.S. Financial institution | $3.1 billion |

| 8. | Rocket Mortgage | $3.0 billion |

| 9. | PNC Financial institution | $2.8 billion |

| 10. | NYCB (Flagstar) | $2.8 billion |

There are a selection of various adjustable-rate mortgages, with the 7/1 ARM maybe being the most well-liked currently.

It supplies a full 84 months of fastened funds earlier than changing into adjustable.

Main this class was Chase with $13.2 billion funded, adopted by Financial institution of America with $11.7 billion and Wells Fargo with $11.1 billion.

In fourth was under-fire First Republic Financial institution with $8.9 billion, and Charles Schwab Financial institution rounded out the highest 5 with $4.1 billion.

The underside half of the highest 10 included Union Financial institution, U.S. Financial institution, Rocket Mortgage, PNC Bank, and New York Group Financial institution.

Not too long ago, NYCB’s Flagstar Financial institution unit took over the deposits and sure mortgage portfolios of failed Signature Financial institution.

The subsequent greatest nonbank participant within the 7/1 ARM sport was loanDepot with $2.0 billion funded.

High 5/1 ARM Lenders within the U.S.

| Rating | Firm Identify | 2021 Mortgage Quantity |

| 1. | Chase | $17.3 billion |

| 2. | NYCB (Flagstar) | $3.4 billion |

| 3. | Financial institution of America | $2.6 billion |

| 4. | Charles Schwab Financial institution | $2.4 billion |

| 5. | State Workers CU | $2.3 billion |

| 6. | Signature Financial institution | $1.6 billion |

| 7. | Luther Burbank Financial savings | $1.5 billion |

| 8. | Axos Financial institution | $1.4 billion |

| 9. | Wells Fargo | $1.4 billion |

| 10. | Pacific Premier | $1.2 billion |

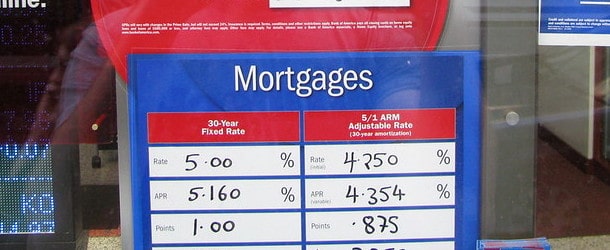

One other in style sort of adjustable-rate mortgage is the 5/1 ARM, which supplies fastened funds for 60 months.

As soon as once more, Chase led on this class with $17.3 billion funded, blowing away the competitors after which some.

In second was NYCB (Flagstar Bank) with $3.4 billion, adopted by Financial institution of America with $2.6 billion.

Fourth place went to Charles Schwab Financial institution with $2.4 billion and State Workers Credit score Union snagged fifth with $2.3 billion.

The North Carolina-based firm was the one credit score union to make the top-10 listing.

Sixth place went to now-defunct Signature Financial institution and so-called boutique financial institution Luther Burbank Financial savings grabbed seventh.

Axos Financial institution, Wells Fargo, and Pacific Premier Financial institution rounded out the highest ten.

The place to Get an Adjustable-Price Mortgage?

As you possibly can see from these lists, depository banks dominate adjustable-rate mortgage lending.

So should you’re trying to get your arms on an ARM, as a substitute of a boring outdated 30-year fastened, a financial institution could be place to look.

In reality, solely two nonbank lenders made it into the top-25, Rocket Mortgage and loanDepot.

Banks are likely to preserve ARMs and different non-agency loans (Fannie/Freddie/FHA/VA) on their very own books.

This permits them to supply portfolio loans with their very own distinctive phrases that different corporations might not.

If you're contemplating an ARM vs. fixed-rate mortgage, you should definitely pay shut consideration to the unfold between merchandise.

That is the distinction in rate of interest, which is able to enable you decide the potential financial savings, which should even be measured in opposition to the dangers of an ARM resetting increased.

[ad_2]