[ad_1]

This put up could include affiliate hyperlinks that pay us whenever you click on on them.

Maximizing rewards on each greenback you spend permits you to earn invaluable money again, miles, and factors. One of many largest month-to-month bills for many households is paying for lease or a mortgage. But, it has been just about not possible to earn rewards on paying for lease with a bank card, except you have been keen to pay a charge that (typically) was greater than the rewards earned. Enter the Bilt Mastercard, which is the primary bank card to supply fee-free rental funds, regardless of who your landlord is. On this Bilt Rewards bank card overview, we clarify what Bilt Rewards is, the professionals & cons of its bank card, and if the cardboard is value it for renters and owners.

What are Bilt Rewards?

Bilt Rewards is a loyalty program that earns factors when paying lease, utilizing its bank card, and performing different eligible actions. The Bilt Rewards Alliance is a set of greater than two million rental properties throughout the U.S. that allows you to earn rewards by paying lease at taking part properties. And, when you might have the Bilt Rewards bank card, you may earn factors by paying lease to ANY landlord with out paying any charges… even when they don’t settle for bank cards.

Factors earned by Bilt Rewards might be redeemed in a number of methods, together with reserving journey by the Bilt Rewards Travel Portal or transferring to airline and lodge companions. Members may even use their factors to pay their month-to-month lease or save up for a house down cost.

Advantages of the Bilt Rewards Credit score Card

When you might have the Bilt Rewards credit card (referral hyperlink), you’ll take pleasure in the next advantages to save cash, earn rewards, and extra.

Earn rewards when paying lease

Housing prices are often one of many main family finances classes that don’t earn rewards. The Bilt Rewards bank card earns 1x factors per greenback, as much as 50,000 factors per 12 months. When paying by the Bilt portal, you may pay lease to your landlord electronically or by a paper examine.

Pay lease with out a transaction charge

Even when landlords settle for bank cards, they’ll tack on a 3% (or larger) comfort charge. Whereas no one likes this, it is smart as a result of the owner has to pay charges to just accept bank cards.

Whenever you pay your lease with the Bilt Rewards bank card, there aren't any transaction charges. This manner, each you and your landlord are glad. You’re not charged additional, they usually get the total lease cost.

Factors switch to companions

Bilt Rewards supply super worth when transferred to its 9 airline and two lodge companions. Factors switch on a 1:1 foundation with no charges. Relying on the way you redeem them, your factors may very well be value hundreds of {dollars}.

Journey cancellation & interruption

In case your journey is canceled or interrupted, the Bilt bank card has your again. You’re lined as much as $5,000 per individual when your reservations are made utilizing the cardboard. This profit covers paid-in-full reservations which can be non-cancellable.

Journey delay reimbursement

Delays are taking place an increasing number of whenever you journey. Having journey delay protection minimizes the ache and helps to cowl your bills. When your journey is delayed by six hours or extra, you’ll obtain as much as $200 per day per traveler (max of $1,800 per journey).

Auto rental collision harm waiver

Keep away from paying for pricey insurance coverage when renting a automobile. Whenever you use your Bilt Mastercard to pay in your rental, you’ll obtain major insurance coverage in opposition to harm or theft to the rental automobile without spending a dime.

No international transaction charges

When making purchases internationally, many bank cards cost international transaction charges of as much as 3%. This hidden tax makes your entire purchases dearer. The Bilt bank card has no international transaction charges so you should utilize your card with out fear.

Month-to-month Lyft credit

Each calendar month that you just pay for 3 Lyft rides, you’ll obtain a $5 Lyft credit score out of your Bilt Mastercard.

No annual charge

With no annual charge, all the rewards and advantages of the Bilt credit card are free for you. Many journey bank cards that supply comparable advantages cost annual charges of $95 or extra. And it’s one of many few bank cards with transferable factors with no annual charge.

The downsides of the Bilt Rewards Credit score Card

There are many positives for the Bilt Mastercard, however no card is ideal. These are the downsides that might maintain you from making use of for this card:

- No welcome bonus. New cardholders don't obtain a welcome bonus when they're permitted for the Bilt bank card. Nevertheless, there isn't a annual charge, and the cardboard gives advantages solely obtainable by bank cards that cost yearly charges.

- No money again possibility. Though you may’t redeem straight for money again, you should utilize your factors to pay (all or a few of) your month-to-month lease.

- Journey bonus purchases are restricted. To earn the 2x bonus factors on purchases, you could e book straight with airways, motels, and automobile rental companies or the Bilt Journey Portal. Different on-line journey companies, like Expedia, Hotwire, or Priceline don't qualify.

- No rental profit for owners. Individuals who personal their properties could query the worth of this card since they'll’t earn factors when paying lease.

- Larger minimal level switch quantity. Different versatile level currencies have minimal switch increments of 1,000 factors. Whereas this can be a drawback in case you have a small steadiness, most vacationers switch factors in bigger quantities to e book award journey. Fundamental members switch factors in 2,000 increments till reaching elite standing by incomes 25,000 factors in a 12 months. Then, factors are transferred in 1,000 increments like different versatile level applications.

Relying on the way you spend and which bonus classes are most vital to you, the Bilt Rewards bank card could or might not be a great match. As all the time, our recommendation is to hunt out rewards credit cards that supply a mix of beneficiant welcome bonuses, excessive incomes energy, enticing advantages, and low (web) charges.

The best way to earn Bilt Rewards factors

Members can earn Bilt Rewards factors in 5 alternative ways:

- Paying lease by the Bilt Rewards Alliance. There are over two million properties the place you may earn rewards by paying lease with none add-on charges.

- Bilt Rewards Alliance promotions. Some properties supply bonus factors for signing or renewing leases, referring tenants, and different actions.

- Paying lease with the Bilt Rewards bank card. Even when your rental property isn’t a part of the Bilt Rewards Alliance, when you might have the Bilt credit card, you may pay ANY landlord lease by the Bilt cell app. In the event that they don’t settle for digital funds, Bilt mails them a paper examine.

- Utilizing the Bilt Rewards Mastercard. Use the Bilt Rewards bank card in your every day purchases to earn as much as 3x factors on each buy. Bonus classes embody 2x factors on journey and 3x points on dining.

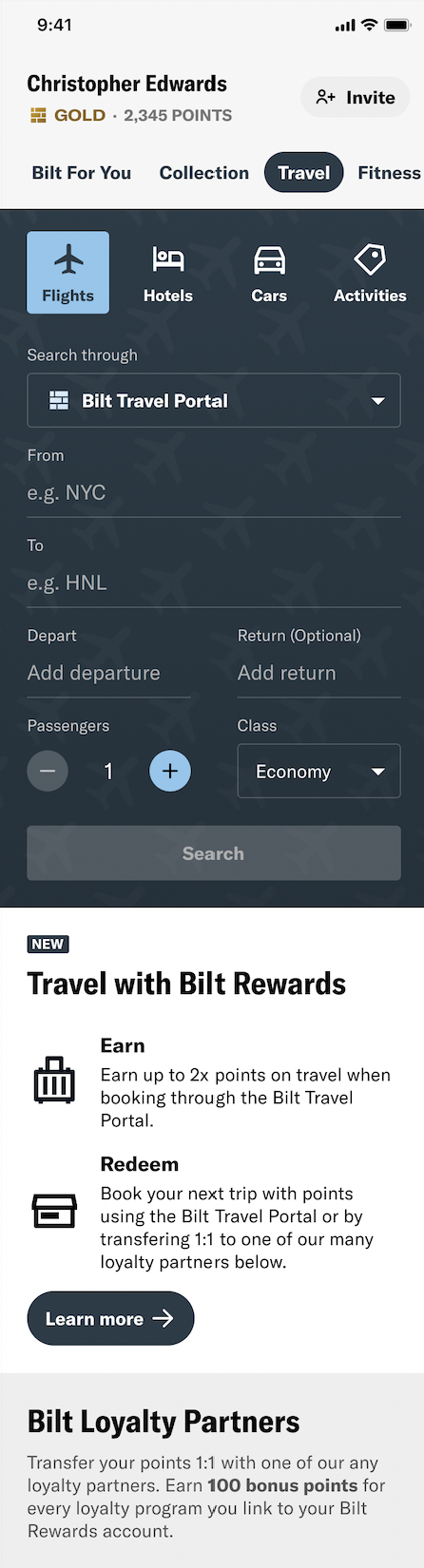

- Reserving by the Bilt Rewards Journey Portal. Whenever you e book flights, motels, and extra by the Bilt Rewards Journey Portal, you’ll earn as much as 2x factors in your reservations. You’ll even earn factors on the money portion of any factors & miles journeys that you just e book.

What are Bilt Rewards factors value?

The worth of Bilt Rewards factors varies primarily based on how they're redeemed.

- Transfers to companions. Values rely upon how they're redeemed upon switch. However, members can count on to obtain 1.5 to 2 cents per level or larger when used strategically.

- Guide by the Bilt Journey Portal. Factors are value 1.25 cents every for reserving flights, motels, rental automobiles, and extra.

- Pay month-to-month lease. Varies primarily based on which constructing you're renting and who manages the property. The property supervisor units values.

- Save for a home down cost. As much as 1.5 cents every.

- Gymnasium courses. About 1 cent per level.

- Distinctive artwork. Is dependent upon the piece of artwork. In lots of circumstances, the art work itself might be troublesome to worth.

You’ll discover the very best values whenever you redeem factors by the Bilt Travel Portal, save up for a home down cost, or by transferring them to airline and lodge companions.

The best way to redeem Bilt Rewards factors for max worth

Redeeming Bilt Rewards factors is straightforward by its web site or cell app. Members have many choices described above, however I need to deal with three of my favorites – lodge and airline switch companions, real-time award searches, and reserving by the Bilt Rewards Journey Portal.

Resort and airline switch companions

Bilt Rewards switch to 11 airline and lodge switch companions on a 1:1 foundation. You’ll get probably the most worth when transferring to the airways as a result of their miles and customarily value greater than 1.5 to 2 cents every. Typically, I wouldn’t switch to its lodge companions besides to prime off your account to e book a reservation as a result of most lodge factors are value 1 cent or much less.

Switch companions embody:

- American Airways AAdvantage

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Cathay Pacific Asia Miles

- Emirates Skywards

- Hawaiian Airways HawaiianMiles

- IHG One Rewards

- Turkish Miles&Smiles

- United MileagePlus

- World of Hyatt

- Virgin Atlantic Flying Membership

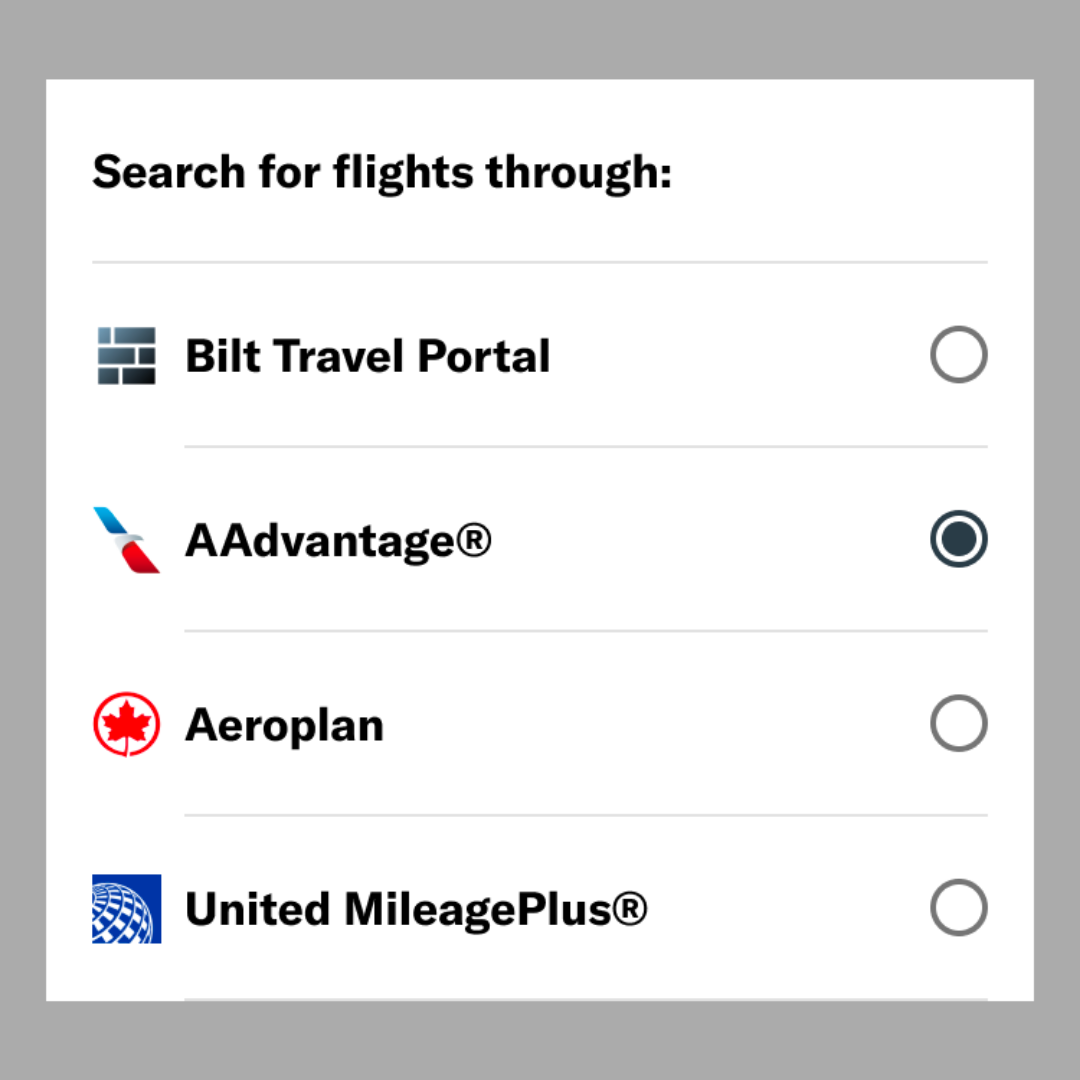

Seek for real-time award availability

Whereas many versatile level applications help you switch factors to their airline and lodge companions, none supply the flexibility to seek for award house to e book flights or rooms. Bilt Rewards modifications the sport with real-time award availability searches with American Airways, Air Canada Aeroplan, and United Airways.

Few issues are extra irritating than transferring factors to an airline, then discovering out that the flight you wished to e book isn’t obtainable or the value modified. With Bilt Rewards, you may seek for real-time award availability to switch and e book your award flight with confidence. How cool is that?!?

Guide journey by the Bilt Rewards Journey Portal

You’ll get 1.25 cents per level in worth when reserving flights, motels, rental automobiles, and extra by the Bilt Rewards Journey Portal. The screenshot beneath exhibits what the cell app interface appears like when reserving journey utilizing your money, factors, or a mix of the 2.

Ought to I get the Bilt Rewards bank card?

The choice of whether or not or to not apply for the Bilt Rewards credit card varies primarily based on whether or not you lease or personal your private home. Listed here are elements to think about:

Individuals who lease

Should you’re a renter, getting the Bilt Rewards bank card is a no brainer. It's the best choice to earn rewards when paying your month-to-month lease with none charges. The cardboard contains quite a lot of advantages that lower your expenses, and also you’ll discover good worth when utilizing your factors to pay for lease, save for a down cost, e book journey, or switch to companions.

Owners

Whereas owners can’t earn rewards when paying their mortgage, the Bilt Mastercard gives sufficient advantages and rewards to make it worthwhile. First off, there isn't a annual charge for having the cardboard, which makes it a long-term keeper. You’ll earn as much as 3x factors on journey and eating purchases. Plus, redeeming factors by the Bilt Rewards Journey Portal or its airline and lodge switch companions gives super worth. And Bilt is the one versatile factors program that transfers to each United Airways and American Airways.

The Bald Ideas

The Bilt Rewards bank card is focused at renters who need to earn rewards by paying lease, nevertheless it gives sufficient distinctive advantages the place I feel the cardboard gives worth for anybody. There is no such thing as a annual charge, which makes it a long-term keeper, and you may earn as much as 3x factors on its bonus classes. Bilt Rewards supply larger worth when reserving journey or transferring to its 11 airline and lodge companions. And the most important profit is seeing real-time award availability with American, United, and Air Canada, which no different card gives.

What are your ideas concerning the Bilt Rewards bank card? Is the cardboard value it, or is there a distinct card that makes extra sense for the best way you spend and redeem rewards?

[ad_2]