[ad_1]

Axis Financial institution has very many premium and tremendous premium bank cards and likewise the Atlas Credit score Card which serves a number of segments without delay: from journey to tremendous premium (or) even an Extremely premium phase, primarily based on spends.

Axis Financial institution Atlas Credit score Card is considered one of a sort, fairly distinctive the best way it really works however on the identical time appears to be like sophisticated for many. That mentioned, right here’s a easy information that will help you perceive it higher and use it successfully, if you happen to select to use for one.

Overview

| Sort | Journey Credit score Card |

| Reward Fee | 2% to 10% |

| Annual Charge | 5,000+GST |

| Finest for | Direct Lodge & Airline Spends |

| USP | Tiered advantages primarily based on spends |

Axis Financial institution Atlas bank card has been not too long ago face-lifted by rising the common reward fee and including extra spend classes that earns accelerated rewards.

Ideally its finest suited for individuals who pay loads of resort payments (or) airline expenses. But it surely may also be used for different advantages. Let’s start with the payment.

Charges

| Becoming a member of Charge | 5,000 INR+GST |

| Welcome Profit | 5000 Edge Miles (10,000 INR worth simply) |

| Renewal Charge | 5,000 INR+GST |

| Renewal Profit | 2,500 Edge miles (Silver) 5,000 Edge miles (Gold) 10,000 Edge miles (Platinum) |

| Renewal Charge waiver | Nil |

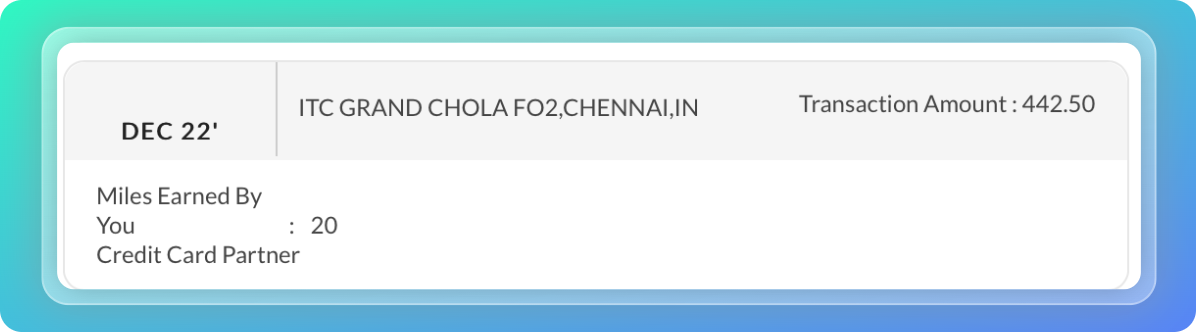

The welcome advantage of 5K edge miles could be transferred to ITC (amongst others) and could be redeemed for 10,000 INR price of keep, meals, and many others at ITC lodges.

Meaning you’re paying 5K and getting 10K worth – doubling the worth of your cash identical to that.

There are extra companions with a great conversion fee and we’ll discover them later under.

Whereas there isn't a renewal payment waiver possibility on this card, the advantage of the Atlas Credit score Card is that it offers higher renewal profit if you happen to spend extra through the card anniversary 12 months.

The renewal profit is kind of profitable, particularly with the platinum tier. However do not forget that even gold tier is adequate to get 2X worth of the renewal payment paid.

Design

The design appears to be like not solely neat, easy and exquisite but additionally related to the kind of card, so is the selection of identify: Atlas.

For those who’ve had the cardboard in hand, you'd agree that the cardboard appears to be like and feels nearly as good as you see within the picture above.

Rewards

Not like all different Axis Credit score Playing cards, Axis Atlas doesn’t earn “Edge Rewards”, nevertheless it earns “Edge Miles”.

It’s a separate miles stability that displays on the Axis Edge Rewards account and isn't linked with every other product up to now.

| SPEND TYPE | Edge Miles | REWARD RATE (EDGE REWARDS PORTAL) | REWARD RATE (POINTS TRANSFER) |

|---|---|---|---|

| Common Spends | 2 / 100 INR | 2% | ~4% |

| Axis Journey Edge Portal | 5 / 100 INR | 5% | ~10% |

| Airways & Motels (Direct) | 5 / 100 INR | 5% | ~10% |

It's to be famous that if you happen to intend to pre-pay for flights/lodges utilizing journey edge portal, Axis Magnus is lots higher possibility than Atlas Credit score Card.

Redemption

There are a number of choices to redeem edge miles, broadly divined into two, as under:

- Redeem on Journey Edge portal: 1:1 (for flights/lodges)

- Switch Edge miles to airline/resort companions

Whereas redeeming on journey edge portal is the tremendous easy possibility with a static worth, we don’t get nice worth there.

As a substitute, one can switch the factors to airways and lodges and get fairly good worth. Right here’s a fast have a look at the switch ratio.

| Airline | Conversion Fee (Edge Miles:Associate Miles) |

|---|---|

| All Airways* | 1:2 |

| Motels: IHG & ITC | 1:2 |

| Lodge: Marriot Bonvoy | 2:1 |

- Airways: United, Singapore Airways, Turkish, Etihad, Qatar, Air France, Ethiopian, Vistara & Spicejet

As you possibly can see, the switch ratio is 1:2 throughout all airways & lodges, apart from Marriott Bonvoy which is at 2:1. So it’s not clever to switch these factors to Marriott from Atlas Credit score Card.

For those who’re into Marriott, you possibly can nonetheless switch your factors to ITC after which to Marriott (2 ITC factors = 3 MB factors), however that is restricted to 60K factors per 12 months.

Usually, ITC is the goto possibility for many cardholders to get higher worth, because it’s lot simpler and likewise permits to switch the factors additional to Marriott Bonvoy.

For those who want to discover worldwide airline redemptions, our easy guides are right here: Singapore Airlines – KrisFlyer & United Airlines – MileagePlus (extra to comply with quickly).

Milestone Profit

| Spend Requirement | Milestone Profit |

|---|---|

| 3 Lakhs | 2,500 Edge Miles |

| 7.5 Lakhs | 5,000 Edge Miles |

| 15 Lakhs | 10,000 Edge Miles |

Assuming you’re capable of do “common” spends of 15 Lakhs, you’ll get 40,000 Edge miles that may be simply valued at 80,000 INR and even 1,60,000 INR (airline candy spots), with reward charges nearly as good as 5.3% to 10.6% respectively.

However do not forget that pockets & rental spends wont be thought-about for milestone advantages.

Membership Tiers

| Annual Spends | Membership Tier |

|---|---|

| < Rs. 7.5 lacs | Silver |

| Rs. 7.5 lacs to Rs. 15 lacs | Gold |

| Rs. 15 lacs & above | Platinum |

Axis Atlas Credit score Card comes with membership tiers and it’s a novel system within the bank card trade.

The membership tiers are purely primarily based on bank card spends with Platinum tier on high that offers entry to many of the airport advantages, together with luxurious airport transfers which is offered solely with the costly Axis Reserve.

Airport Companies

Axis Financial institution Atlas Credit score Card offers you entry to under airport providers relying on the membership tier you’re in:

Listed below are the complimentary limits on respective tiers for airport providers.

| Membership Tier | Airport Meet & Greet | Airport Switch |

|---|---|---|

| Silver | – | – |

| Gold | 2 | – |

| Platinum | 4 | 2 |

Nevertheless, word that these airport providers can neither be booked on the Extraordinary weekends portal nor by concierge line, not like the opposite playing cards like Magnus & Reserve.

With Atlas, airport providers could be booked solely by the Atlas Dashboard on app/web site and that’s not one thing you'd take pleasure in doing.

Airport Lounge Entry

The complimentary lounge entry limits on Axis Atlas Credit score Card additionally works as per the tiered system talked about under.

| Membership Tier | Home Visits | Worldwide Visits |

|---|---|---|

| Silver | 8 | 4 |

| Gold | 12 | 6 |

| Platinum | 18 | 12 |

- Be aware: Above visits covers each Main cardholder + company, if any.

So, as you see above, the excellent news concerning the Atlas Card is that we are able to avail these complimentary lounge entry each for major cardholder & company, identical to the Axis Reserve Credit score Card.

Nevertheless, word that it’s not effectively applied each at terminal & with QR system, for ex, if you happen to add 1 visitor to the go to, you’ll be charged, which isn't the case with Reserve.

In order of now, you’ll be charged the payment for company and the charges will be auto reversed as confirmed by Axis buyer help.

Must you take Atlas?

For most individuals, Axis Magnus (or) Axis Reserve bank card would do.

However listed here are some the reason why it's worthwhile to have Atlas in your pockets, even if in case you have different Axis bank cards.

- Your direct airline & resort spends are excessive (>5 Lakhs a 12 months).

- You may spend 15L simply, in order to get greater reward fee.

- You want lounge entry for company.

- You need to expertise the USP of Magnus and reserve and but gentle on pocket.

- You do lot of direct worldwide resort spends, as this provides a great internet acquire (~5.8%) on foreign exchange resort spends.

Whereas we can provide extra causes, the one cause that I typically see throughout many Atlas cardholders is the #1 cause listed above.

For ex, on spends of 5L with lodges & airways, you'd get 50K price of miles with atlas, whereas with Magnus you'd solely get ~25k miles. So greater the spends on this class, greater the reward fee.

However Be aware that you could additionally use journey edge and get 5X rewards on Magnus for pay as you go lodges/flights and get lots greater reward fee. So Atlas is basically reserved for incidental resort spends or for airline expenses.

My Expertise

I obtained the Axis Atlas Credit score Card few months in the past, primarily to expertise the product because it’s fairly distinctive within the trade.

They’ve a devoted card administration dashboard for Atlas on Cellular & net-banking due to the membership tier system and different advantages.

Aside from that, the 5X rewards will get credited for resort spends on time, hopefully so for airways. I did a small txn few months in the past to examine the identical and it does work as anticipated.

Eligibility

- Annual Earnings: 9 Lakhs & above

- Present different Financial institution Credit score Card: ~3 Lakhs (or) above restrict

For those who’re dealing with any points (or) if you happen to choose to have a clean experience into Axis Credit score Card Ecosystem, do try this learners information to Axis Financial institution Credit score Playing cards: Maximizing Axis Bank Credit Cards.

The best way to Apply?

Chances are you'll apply online on Axis website in a matter of few clicks. Axis Financial institution is not too long ago recognized for processing recent bank card functions fairly quick.

Chances are you'll get the cardboard accredited often inside per week from the date of software.

For those who’re new to financial institution, to not fear, you don’t have to open a recent Axis Financial institution Financial savings A/c to get an Axis Credit score Card.

Backside line

General Axis Atlas Credit score Card is a totally loaded card at this payment vary and has the flexibility to present experiences that solely an extremely premium bank card can provide – all you want is the excessive spend potential.

For those who intend to have 3 finest premium bank cards from Axis Financial institution, this may be one amongst – others being Axis Magnus & Axis Vistara Infinite.

Do you’ve Axis Financial institution Atlas Credit score Card? Be at liberty to share your experiences within the feedback under.

[ad_2]