[ad_1]

We all know there’s been loads of dialog surrounding the news about Silicon Valley Bank and, naturally, you'll have questions. It’s essential so that you can know that your cash is secure with SoFi. Now we have a top quality rising deposit base. Now we have ample cushion to the regulatory required fairness to asset ratios. Now we have maintained a powerful unfold between what we cost on loans and our value to fund loans regardless of the next rate of interest atmosphere. Importantly, we've no belongings with Silicon Valley Financial institution—our solely publicity is a small lending facility (i.e. the power to borrow cash) beneath which we've borrowed lower than $40m, and which is unaffected by the FDIC’s receivership of Silicon Valley Financial institution.

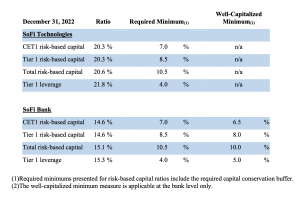

Belief and security for our 5.2 million members and their cash are our primary precedence, which is why we wish you to know all of the methods we work to maintain your cash secure. As a nationally chartered financial institution, SoFi is targeted on complying with the strict regulatory requirements it's held to by the Federal Reserve, the Workplace of the Comptroller of the Forex, the Federal Deposit Insurance coverage Company (FDIC), the Securities and Alternate Fee, the Securities Investor Safety Company, and others. Under we define the capital ratios that we should meet or exceed as required by our Nationwide Financial institution Constitution. As well as, SoFi Financial institution deposits are insured by the FDIC as much as $250,000 per particular person and $500,000 per joint account, and 90% of our deposits are beneath these limits and absolutely insured. We may also help defend your accounts from fraud with 24/7 account monitoring and the power to freeze your debit or bank card immediately within the SoFi app.

We thought it was value taking this chance to underscore some traits of our technique and our enterprise mannequin, particularly because it regards our Checking and Financial savings merchandise supplied by SoFi Financial institution.

Our aim is to supply our members with best-in-class merchandise that assist them get their cash proper throughout comfort, pace, content material, and value. First, we offer a extremely aggressive rate of interest on checking and financial savings. This key level of distinction together with our absolutely digital functionality to spend, save, and pay all out of your cellphone helps drive folks to make use of SoFi as their main checking account, as evidenced by high-quality direct deposit development. Actually, 88% of year-end 2022 deposit balances have been from direct deposit members, and roughly 50% of newly funded SoFi Checking & Financial savings accounts are establishing direct deposit by day 30.

These sturdy traits haven't modified, as we surpassed $7.3 billion in deposits (up 46% quarter-over-quarter) in This autumn’22. Our common steadiness for direct deposit members is slightly below $25,000, which is FDIC-insured. Actually, over 90% of our deposits are insured, which is effectively above trade benchmarks.

The efficient unfold we earn between the yield on our loans and the curiosity paid to our members on their deposits (in addition to different sources of capital) permits SoFi to proceed to innovate and put money into product differentiation, higher companies, higher costs and extra aggressive charges for our present and potential members.

We all know belief and the protection of your cash are high priorities when choosing a financial institution, and we take that very critically right here at SoFi. Serving to you obtain your monetary targets and be ok with your cash, whereas doing it's our primary precedence.

We’ve included solutions to some FAQs we’ve acquired from buyers and shareholders beneath.

Incessantly Requested Questions from Traders & Shareholders

Do you've got publicity to Silicon Valley Financial institution (SVB)?

We don't maintain belongings with SVB. Our solely publicity is a small lending facility beneath which we've borrowed lower than $40m and which is unaffected by the FDIC’s receivership of SVB.

Are my deposits insured and to what quantity?

SoFi Financial institution deposits are insured by the FDIC as much as $250,000 per particular person and $500,000 per joint account.

What number of deposits does SoFi have? What number of of these are above the FDIC insurance coverage limits?

As of the top of This autumn’22, we had $7.3B in complete deposits, up $2.3 billion versus Q3’22. We see sturdy development persevering with in 2023.

Now we have not traditionally supplied data on the typical deposit steadiness at SoFi, nor the variety of accounts funded above the FDIC threshold of $250,000. Nevertheless, we supplied in our recently-released annual report on Type 10-Ok that as of December 31, 2022, the quantity of uninsured deposits totaled $615.9 million, that means over 90% of our deposits are insured.

How do you concentrate on the stickiness of your deposits versus folks simply chasing the very best charges?

As of the top of This autumn’22, 88% of our member deposits have been from direct deposit accounts. Direct deposit helps drive folks to make use of SoFi as their main checking account. This view can also be in step with federal banking rules that acknowledge the stickiness of retail deposits.

What different sources of funding do you employ for loans to SoFi members? Is there a restrict or ratio of how a lot of the deposits you should use?

We rely on deposits, warehouse line financing from giant cash heart banks and our personal capital to fund loans to members. As of year-end 2022, we had borrowing capability of $8.4bn beneath mortgage warehouse amenities, of which $3.1bn, or 36%, have been drawn. Moreover, we've roughly $3 billion in our personal fairness capital that we are able to use to fund loans and, as talked about above, $7.3 billion of deposits on the finish of 2022, and we see sturdy development persevering with in 2023. In complete we've ~$18 billion of obtainable capability to fund loans and meet our liquidity wants.

What has been the development in deposits?

Deposits grew by $2.3bn in This autumn’22, by $2.3bn in Q3’22 and by $1.6bn in Q2’22.

Do you've got a portfolio of AFS (obtainable on the market) securities?

As of YE22, we've solely $195mm in truthful worth of AFS debt securities of our complete belongings of $19 billion. These consist primarily of U.S. Treasuries (60%), with 48% of the securities due inside one 12 months, and 93% due between 2-5 years.

Are there limits to how a lot you possibly can lend?

Sure, along with our judgment of sound enterprise technique and practices with the intention to drive shareholder worth and the extra oversight of our danger committee, credit score committee, and numerous Federal regulators, we're required to fulfill sure capital ratio minimums. Particularly, the desk beneath outlines every capital ratio minimums required at our OCC Financial institution Constitution and at our holding firm, in addition to our reported capital ratios, which exceed all necessities by vital quantities.

If there are loans in your steadiness sheet, how do you defend their worth if the mortgage’s price is fastened, whereas Fed Funds and benchmark rates of interest enhance?

Once we fund a mortgage we hedge the rate of interest danger of that mortgage with the intention to account for the chance to the worth of the mortgage from rates of interest altering. Particularly, we enter into by-product contracts to handle future mortgage sale execution danger for loans on our steadiness sheet. Our hedging intentions are to economically hedge the chance of unfavorable adjustments within the truthful values of our private loans, scholar loans and residential loans. Our by-product devices used to handle future mortgage sale execution danger embody rate of interest swaps, rate of interest caps and residential mortgage pipeline hedges.

Does the potential influence of the SVB receivership on start-ups have an effect on your enterprise?

We don't provide enterprise banking companies, so we don't take deposits from or make loans to companies of any measurement, together with start-ups. Nevertheless, we do rely amongst our Know-how Platform prospects a number of technology-based corporations, a few of which can have a relationship with SVB. We're in communication with our largest Know-how Platform companions and we're not conscious of any influence on our enterprise from personal or public corporations with potential publicity to SVB.

Cautionary Assertion Concerning Ahead-Wanting Statements

Sure of the statements above are forward-looking and as such aren't historic info. These forward-looking statements aren't ensures of efficiency. Such statements may be recognized by the truth that they don't relate strictly to historic or present info. Phrases comparable to “we see”, “anticipate”, “imagine”, “proceed”, “might”, “count on”, “intend”, “might”, “future”, “technique”, “may”, “plan”, “ought to”, “would”, “can be”, “will proceed”, “will doubtless outcome” and related expressions might establish forward-looking statements, however the absence of those phrases doesn't imply {that a} assertion shouldn't be forward-looking. Components that would trigger precise outcomes to vary materially from these contemplated by these forward-looking statements embody: (i) the impact of and uncertainties associated to macroeconomic elements comparable to inflation, rising rates of interest and any influence or deterioration within the banking trade and credit score markets, together with associated to the closure of Silicon Valley Financial institution; (ii) our potential to realize profitability and continued development throughout our enterprise sooner or later; (iii) the influence on our enterprise of the regulatory atmosphere and complexities with compliance associated to such atmosphere, together with any additional extension of the scholar mortgage fee moratorium or mortgage forgiveness, and our expectations concerning the return to pre-pandemic scholar mortgage demand ranges; (iv) our potential to appreciate the advantages of being a financial institution holding firm and working SoFi Financial institution; (v) our potential to reply and adapt to altering market and financial situations, together with inflationary pressures and rising rates of interest; (vi) our potential to proceed to drive model consciousness and notice the advantages or our built-in multi-media advertising and promoting campaigns; (vii) our potential to vertically combine our companies and speed up the tempo of innovation of our monetary merchandise; (viii) our potential to handle our development successfully and our expectations concerning the event and growth of our enterprise; (ix) our potential to entry sources of capital on acceptable phrases or in any respect, together with debt financing and different sources of capital to finance operations and development; (x) the success of our continued investments in our Monetary Providers phase and in our enterprise typically; (xi) the success of our advertising efforts and our potential to increase our member base; (xii) our potential to take care of our management place in sure classes of our enterprise and to develop market share in present markets or any new markets we might enter; (xiii) our potential to develop new merchandise, options and performance which are aggressive and meet market wants; (xiv) our potential to appreciate the advantages of our technique, together with what we consult with as our Monetary Providers Productiveness Loop; (xv) our potential to make correct credit score and pricing selections or successfully forecast our loss charges; (xvi) our potential to determine and keep an efficient system of inner controls over monetary reporting; (xvii) our expectations with respect to our anticipated funding ranges in our Know-how Platform phase and our anticipated margins in that phase, together with our potential to appreciate the advantages of the Technisys acquisition; and (xviii) the result of any authorized or governmental proceedings which may be instituted in opposition to us. The foregoing checklist of things shouldn't be exhaustive. It is best to rigorously think about the foregoing elements and the opposite dangers and uncertainties set forth within the part titled “Danger Components” in our final annual report on Type 10-Ok, as filed with the Securities and Alternate Fee, and people which are included in any of our future filings with the Securities and Alternate Fee.

These forward-looking statements are primarily based on data obtainable as of the date hereof and present expectations, forecasts and assumptions, and contain quite a few judgments, dangers and uncertainties. Accordingly, forward-looking statements shouldn't be relied upon as representing our views as of any subsequent date, and we don't undertake any obligation to replace forward-looking statements to replicate occasions or circumstances after the date they have been made, whether or not on account of new data, future occasions or in any other case, besides as could also be required beneath relevant securities legal guidelines.

Because of quite a few identified and unknown dangers and uncertainties, our precise outcomes or efficiency could also be materially totally different from these expressed or implied by these forward-looking statements. You shouldn't place undue reliance on these forward-looking statements.

Availability of Different Info About SoFi

Traders and others ought to notice that we talk with our buyers and the general public utilizing our web site (https://www.sofi.com), the investor relations web site (https://investors.sofi.com), and on social media (Twitter and LinkedIn), together with however not restricted to investor shows and investor truth sheets, Securities and Alternate Fee filings, press releases, public convention calls and webcasts. The knowledge that SoFi posts on these channels and web sites might be deemed to be materials data. Consequently, SoFi encourages buyers, the media, and others involved in SoFi to overview the knowledge that's posted on these channels, together with the investor relations web site, regularly. This checklist of channels could also be up to date once in a while on SoFi’s investor relations web site and should embody further social media channels. The contents of SoFi’s web site or these channels, or some other web site which may be accessed from its web site or these channels, shall not be deemed integrated by reference in any submitting beneath the Securities Act of 1933, as amended.

[ad_2]