[ad_1]

Whole Curiosity Paid on a $500,000 Mortgage:

- Might 2021: $220,000

- NOW: $710,000

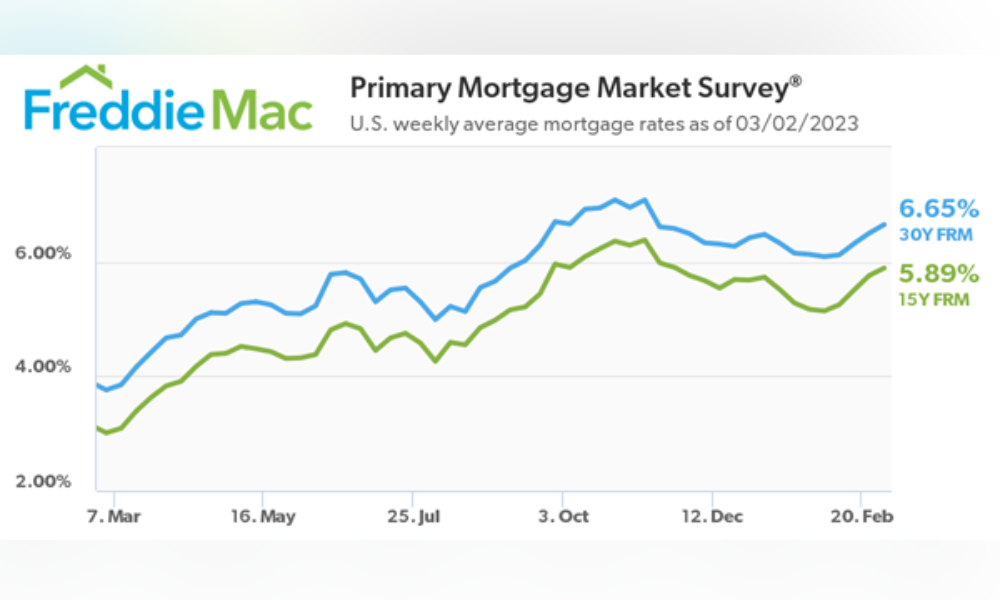

In 18 months, mortgage charges have risen from 2.5% to 7.1%.

Additional, the housing affordability index is formally beneath 2008 ranges.

The properly overdue housing market correction is on its means.

— The Kobeissi Letter (@KobeissiLetter) March 2, 2023

Certainly, mortgage applications have plummeted amid hikes to the 30-year fastened fee. The Mortgage Bankers Affiliation final month reported a 13.3% decline in mortgage functions as buy functions fell to their lowest degree since 1995.

Genevieve Roch-Decter, CFA, used the instance of the influence on a median-priced house at a 7% fee. A down cost on a $467,700 house would require a $93,540 down cost with month-to-month mortgage funds of $2,514. “Is that this doable for the typical American?” she requested rhetorically.

Mortgage charges are again above 7%. At that fee, this is what shopping for a median house within the US appears like:

- $467,700 value

- $93,540 down cost

- $2,514 month-to-month mortgage cost

Is that this doable for the typical American?

— Genevieve Roch-Decter, CFA (@GRDecter) March 2, 2023

“No-one is promoting actual property and eliminating a 3% mortgage when rates of interest are 7% in the present day,” Andrew Lokenauth of BeFluentInFinance.com noticed. “That is referred to as the ‘golden handcuff.’ They're handcuffed to the property (financially tied to property on account of low-interest charges), and never promoting to maintain it.”

Nobody is promoting actual property and eliminating a 3% mortgage when rates of interest are 7% in the present day

That is referred to as the "golden handcuff"

They're handcuffed to the property (financially tied to property on account of low-interest charges, and never promoting to maintain it)

Stock is so low

— Andrew Lokenauth (@FluentInFinance) March 2, 2023

[ad_2]