[ad_1]

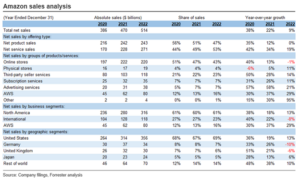

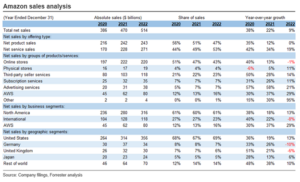

In 2022, Amazon’s whole internet gross sales surpassed the half-trillion-dollar mark, turning into the second US firm after Walmart to achieve that milestone. The corporate’s whole international gross sales amounted to $514 billion in 2022. We reviewed Amazon’s 2022 outcomes to study extra. Some notes:

- Amazon’s whole internet gross sales development fee slowed to 9% 12 months over 12 months (YoY) in 2022, down from 22% YoY in 2021 and 38% YoY in 2020.

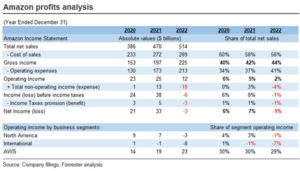

- Its working revenue almost halved in 2022, reaching $12 billion, with the working revenue margin declining from 5% in 2021 to 2% in 2022 (please look beneath for the Amazon income evaluation graphic).

- Amazon generated a $3 billion revenue tax profit in 2022, in comparison with a provision for revenue taxes in 2021. This tax profit was primarily as a result of a lower in pretax revenue and a rise in overseas revenue deductions.

- All informed, the corporate reported a internet lack of $3 billion in 2022, with a internet revenue margin of -1%.

To know the drivers behind Amazon’s gross sales and income efficiency, we analyzed the corporate’s gross sales and income by product teams, nations, and enterprise segments. Following are the highest 10 insights from our evaluation.

- Service gross sales proceed to drive development. Service gross sales embrace third-party vendor charges, Amazon Internet Providers (AWS) gross sales, and gross sales from promoting and subscription providers. Against this, product gross sales embrace income from the sale of merchandise, associated delivery charges, and digital media content material. The share of service gross sales in Amazon’s whole internet gross sales elevated to 53% in 2022, in comparison with 47% for product gross sales. Against this, in 2012, the share of service gross sales was simply 15%. Previously two years alone, service gross sales elevated by $101 billion whereas product gross sales elevated by $27 billion (once more, please see the Amazon gross sales evaluation graphic beneath).

- On-line retailer gross sales development slows down. Amazon generated $220 billion from on-line retailer gross sales in 2022, with a destructive development fee of -1% YoY. The share of on-line retailer gross sales in whole internet gross sales declined from 51% in 2020 to 43% in 2022. The web shops supply a wide array of consumable and sturdy items, in addition to media merchandise in each bodily and digital codecs, corresponding to books, movies, video games, music, and software program. Gross sales to clients who order items on-line for supply or pickup at bodily shops are additionally included.

- Bodily retailer gross sales stay a small portion of whole internet gross sales. In 2022, Amazon generated $19 billion from bodily retailer gross sales, representing 4% of whole internet gross sales. Bodily retailer gross sales embrace income from clients who bodily choose gadgets in a retailer.

- Third-party vendor providers proceed to develop. Amazon generated $118 billion from third-party vendor providers in 2022, with development persevering with within the double digits. The share of third-party vendor providers in whole internet gross sales elevated to 23% in 2022, up from 21% in 2020. The third-party vendor providers embrace commissions, associated achievement and delivery charges, and different third-party vendor providers.

- Subscription providers develop in double digits. Amazon generated $35 billion from subscriptions providers in 2022. Subscription providers embrace annual and month-to-month charges from Amazon Prime memberships, in addition to charges from digital video, audiobook, digital music, e-book, and different non-AWS subscription providers.

- Promoting providers proceed to develop within the excessive double digits. Amazon generated $38 billion from promoting providers in 2022, almost double the income from two years earlier. Promoting providers embrace gross sales of promoting providers to sellers, distributors, publishers, authors, and others, by means of applications corresponding to sponsored advertisements, show, and video promoting.

- “Different” gross sales stay a small portion of whole gross sales. Amazon’s “different” gross sales, associated to numerous choices corresponding to licensing and distribution of video content material and delivery providers, in addition to co-branded bank card agreements, grew 95% YoY in 2022. These nonetheless make up lower than 1% of whole gross sales, nevertheless.

- The US drives gross sales development. Amazon generated $356 billion in gross sales from the US in 2022, and the share of the US in whole internet gross sales elevated to 69%. Amazon US gross sales grew by $93 billion between 2020 ($264 billion) and 2022 ($356 billion). Non-US gross sales grew by a complete of $35 billion throughout the identical interval. Amazon’s operations in Germany and the UK reported destructive development in 2022. Nation-specific gross sales embrace gross sales from country-focused on-line and bodily shops or, for AWS functions, from the promoting entity.

- North American and worldwide segments had destructive working revenue. The North America phase, consisting of retail by means of North America-focused on-line and bodily shops, is the corporate’s largest phase, with a 62% share of whole internet gross sales. It continued to develop in double digits in 2022. The share of the worldwide phase, consisting primarily of retail gross sales by means of targeted on-line shops (i.e., outdoors North America), declined from 27% in 2021 to 23% in 2022. Worldwide phase gross sales decreased by -8% YoY in 2022, primarily as a result of modifications in overseas foreign money trade charges. Each the North American and worldwide segments had destructive working margins in 2022.

- AWS is the quickest rising and most worthwhile phase. In 2022, Amazon generated $80 billion in income from AWS providers. AWS providers continued to develop within the excessive double digits. Moreover, its share of whole internet gross sales continues to extend, rising from 12% in 2020 to 16% in 2022. With an working revenue margin of 29%, AWS can also be the corporate’s most worthwhile phase. The AWS phase contains gross sales of compute, storage, database, and different providers for startups, enterprises, authorities businesses, and educational establishments.

In case you are a Forrester shopper, please additionally see our 2022 Retail Competition Tracker, US and 2022 Online Marketplace Tracker, Global to learn the way Amazon compares to different US retailers and international marketplaces.

[ad_2]